Financial Strategy

We Place a Premium on Strategic Guidance and Macro-Level Advice

Financial Strategy

We Place a Premium on Strategic Guidance and Macro-Level Advice

Whilst we deliver end-to-end services including accounting, financial planning, structuring advice, and new entity setups; our point of difference is our simple yet highly specialised approach combining expert financial strategy with exclusive property investment and development expertise.

Through our Strategiq Squad, we combine Australia’s leading network of brokers, property advisors, buyers’ agents, and financial specialists who all focus on momentum and helping our clients to achieve the maximum return on their investment through quality, high performing, and well structured property investments.

Unlike traditional advisory firms, we don’t sell off-the-shelf products – we offer a structured, high-growth property model designed to maximise returns and minimise risk.

We exist to help you build sustainable, scalable wealth through intelligent financial strategy. Whether you’re a business owner looking to enhance performance or an investor ready to grow your portfolio, we create tailored, data-driven plans designed to unlock long-term financial success.

Unlike traditional investment advice, our property method includes partnering with Australia’s best property experts who identify properties offering immediate equity through sophisticated negotiation.

From buyer’s agents to builders and brokers, we deliver a complete, end-to-end investment advisory model.

Our unique approach leverages smart financing and structuring, combined with helping clients secure high-growth properties that offer immediate equity, avoiding the long game of off-the-plan projects or share market investments.

This is what makes our method work.

Leverage Matters

Use as minimal cash as possible; instead leverage borrowed funds to maximise growth.

Compound Impact

Reinvest equity to scale your portfolio and amplify returns over time.

Tax Benefits

Maximise negative gearing and cash flow through smarter structuring.

Tailored Strategy

Every plan is personalised, from entity setup to capital raising and ROI modelling.

Proven Results

Significantly diverging from the transactional nature prevalent in many financial planning firms, our strategy involves a comprehensive evaluation of your financial situation, taking into account the variables and opportunities to optimise wealth creation and tax strategies.

This highlights the Return on Investment (ROI) derived from engaging in more sophisticated financial strategies compared to standard offerings, which are product-based, – pushing investment platforms, insurance and share portfolios..

We also specialise in Self-Managed Superannuation Funds and can provide support and advice from setup to investment choices to ensure your future is safe and financially maximised.

Because better financial advice leads to better choices, better investments, and better outcomes. We’ve seen too many businesses and individuals plateau – not due to lack of potential, but because of lack of clarity and guidance.

We believe in structured, high-impact planning that turns complexity into confidence. Our approach empowers you to take control of your numbers, your opportunities, and your future.

Many CFOs nowadays are ex-Accountants who are trained and focused on accounting, financial reporting and compliance. However this is simply accounting.

The difference in our strategic outsourced CFO approach is a focus on being your strategist, brand builder, problem solver and business leader – the very things that drive business growth. Our outsourced CFO services give you access to expert-level financial leadership and guidance, distilling the complicated into simple strategies – without the cost of a full-time CFO.

We help businesses strengthen their financial foundation through advanced financial reporting insights, system optimisation, trend and data analysis, and proactive performance management. Whether you’re scaling, stabilising, or planning for long-term growth, we help you move forward with confidence.

We also provide investment advisory, venture capitalist (VC) sourcing assistance and project management and advisory of private equity purchases, including financial structuring and liaison with other stakeholders. Through our niche specialities and hands-on approach, we have connections right through the value chain.

Keen to learn more? Get in touch with the team today

Running a business is hard. We make it easier with a practical plan of action to help you get your business where you want it to be so you are able to enjoy the financial freedom you deserve.

Acting as an extension of your business, our experienced business advisors and financial strategists take the time to learn and understand the ins and outs of your operation, so we can draw up an effective roadmap for your success, both for the short and longer-term.

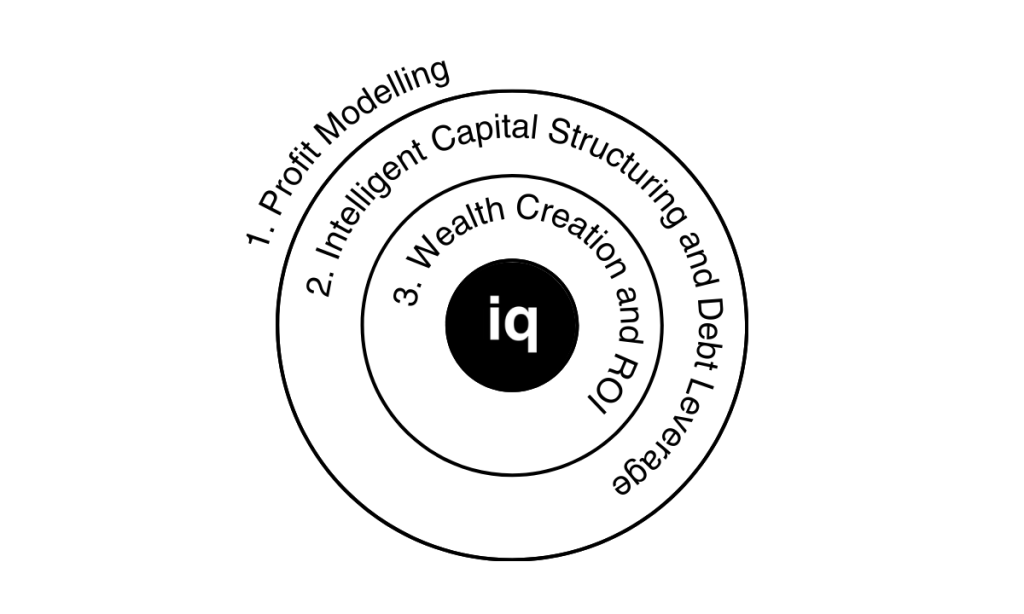

1. Profit Modelling

First, we consult and advise on your business (and/or personal wealth) to ideally double your profits (performance and position enhancement).

2. Intelligent Capital Structuring and Debt Leverage

We use your increased profits to increase lending and leverage so you have more available money at a lower interest rate. We also tailor your financial structures to scale investments safely, efficiently, and profitably.

3. Wealth Creation and ROI

We find you the highest growth properties throughout Australia, purchasing undervalue, to ensure you can use the equity again, and fast. Throughout we are also continually strategising to maximise your tax deductibility to improve long-term wealth accumulation and cash flow.

By repeating this cycle, we compound returns and reinvest strategically, positioning you for sustained wealth and financial freedom.