UNCOVER THE SECRETS TO BUYING PROPERTY WITH YOUR SUPERANNUATION

Let us show you in 15 minutes how to transform the money in your retirement fund.

For many people, their superannuation is one of their most important financial assets.

So it’s not surprising that more and more people are looking at ways to use their super to buy property.

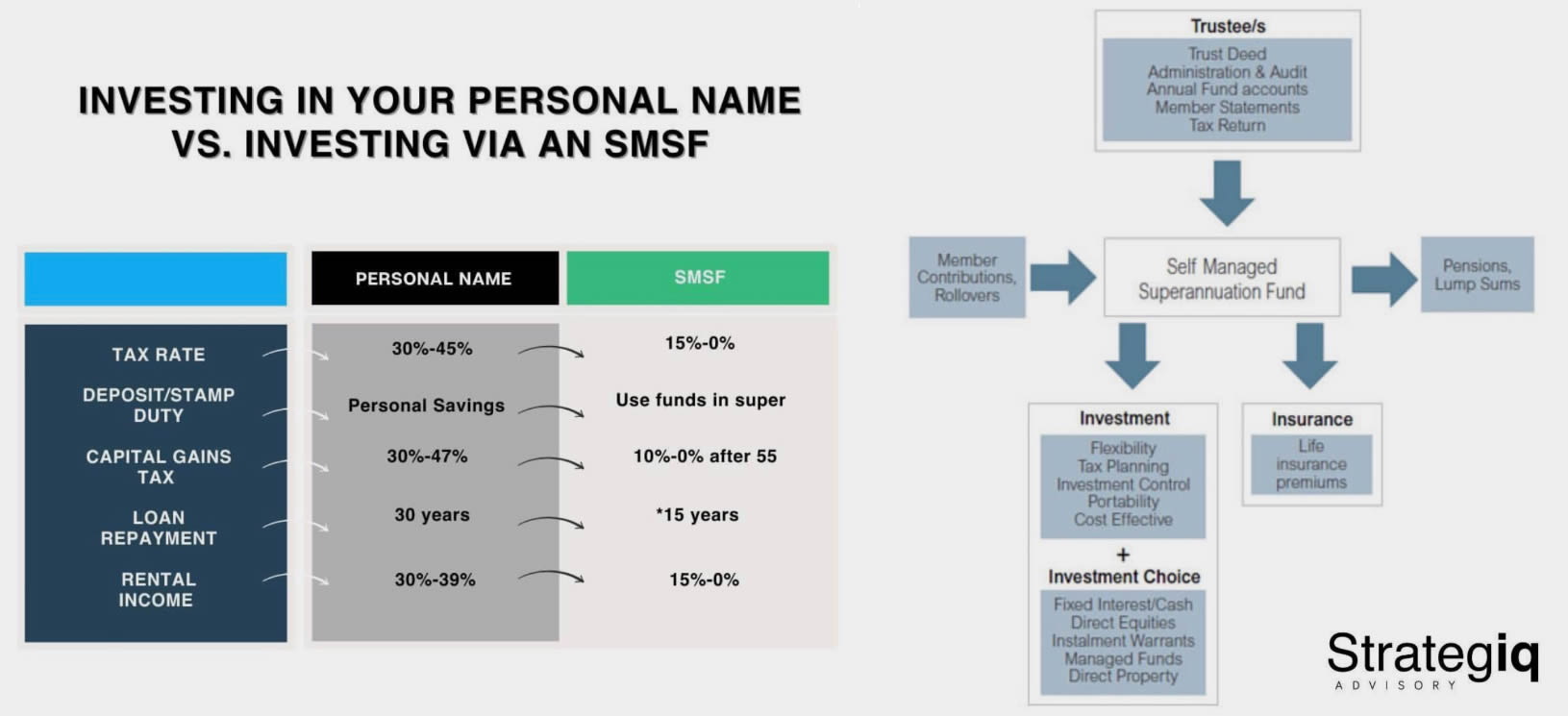

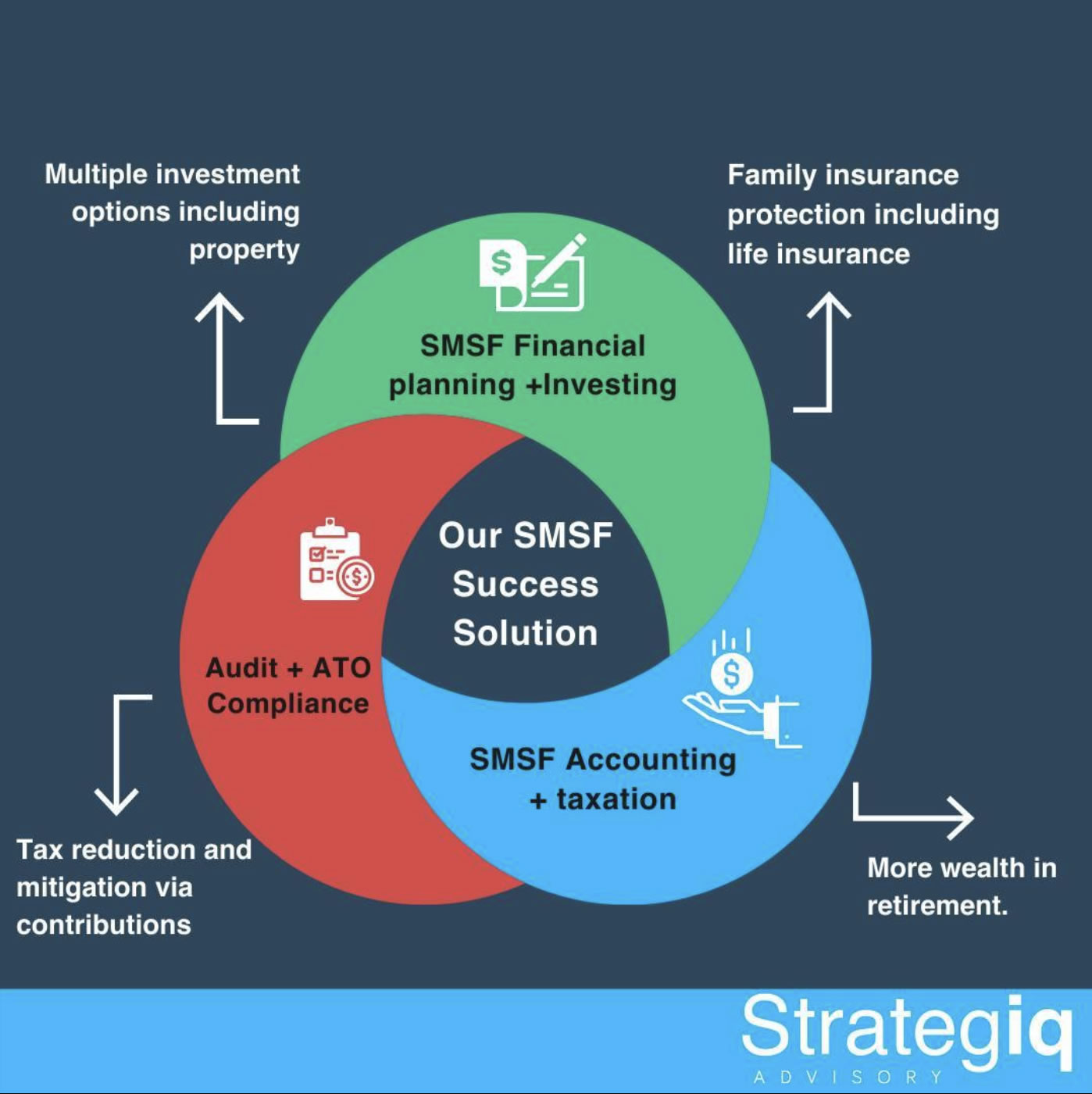

There are a few different ways to do this, but the most common is to set up a self-managed super fund (SMSF) and use it to invest in property.

With the recent changes to Superannuation, it has never been easier to diversify your retirement portfolio and invest your SMSF into a dream home. Property has always been regarded as one of the best and safest investments.

This can be a great way to build your wealth and secure your retirement, but it’s essential to understand the rules and regulations around SMSFs before you get started.

With a little planning and advice, using your super to buy property can be one of the most significant ways to grow your wealth.

If you’re thinking about using your super to buy property, here’s what you’ll need to consider:

- Determine whether an SMSF is right for you.

- Build an investment strategy and set up the components of your fund.

- Begin researching properties that fit your investment strategy.

As SMSF experts, we make this process simple, easy and fast, guiding you every step.

Here are some of the greatest benefits when it comes to SMSF:

Save tax by making contributions into super, whereby the tax is only 15%

SMSF allows you to lease commercial property owned by the SMSF to your business, e.g. a factory bay or office

Allows you to have the family adequately insured should an event occur like death, disability, or cancer!

Purchase property, both residential or commercial

Allows you to have $0 tax once you reach the age of 60 and open a pension within your SMSF

Let us show you in 15 minutes how to transform the money in your retirement fund.

What’s covered in your 15 minute call?

- Your eligibility

- The strategy of how to set the SMSF up in the simplest possible way

- How to purchase property within months

- The additional money that you will make versus staying in your current super

- How much faster will you be able to retire?